FAQs

- Articles

- FAQs

An Automated Valuation Model (AVM) is an algorithm which uses statistical methods to value properties. An AVM is an estimate and should not be confused with a valuation from a registered property valuer.

By UNO home loans, October 17th, 2022

- Articles

- FAQs

Yes, uno allows self-employed borrowers the opportunity to choose the best home loan for their needs.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

uno is a service that allows you to compare home loans intelligently, taking into account your loan amount and personal preferences, as well as complicated interest rate discount structures and mortgage broker strategies

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Yes, uno gives first home buyers all the information they need to find the best home loan available.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

No, uno’s service is free of charge.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Yes, uno has an Australian Credit Licence through ASIC and all of our loan writers are accredited under that licence.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

We will need certain documents from you to recommend home loans and complete your application, including pay slips, bank statements and tax return documents.

By UNO home loans, October 14th, 2022

- FAQs

- Articles

An Expert Review is required so that we can help you choose the a home loan that meets your needs. A review gives our experts the chance to analyse your home loan shortlist and financial situation and recommend products that suit your circumstances.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Traditional mortgage brokers use a set of tools that help them arrive at the home loan they recommend for you, but you often have no idea how or why they came to recommend it.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

Yes, uno could help you find a better deal and save money by giving you the power to compare a range of options from major and specialist lenders across Australia.

By UNO home loans, October 14th, 2022

- Articles

- FAQs

The simplest way to quickly pay down your home loan is to allocate as much income as you can to your mortgage. We've listed 3 steps to take first.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

How much a lender will let you borrow varies from bank to bank, but it will broadly depend on your income, living expenses, existing loan repayments as well as a few other variables.

By UNO home loans, October 13th, 2022

- FAQs

These terms and conditions apply to uno Active Home Loan Management Services operated by or on behalf of Planwise AU Pty Ltd

By UNO home loans, October 13th, 2022

- Articles

- FAQs

You can upload documents through the uno website. Either take a photo or scan the documents in your computer or smartphone.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

You can invite your partner to share your uno account within the Settings section of your uno dashboard, when you’re logged in.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

Want to know how long refinancing your home will take? Curious to know if you could get it done by the end of 2020? Find out more at the UNO website.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

The simplest way to minimise interest repayments over the life of your loan is to allocate as much income as you can to your mortgage while resisting the urge to reborrow anything through a redraw facility.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

Australian credit history files are maintained by VEDA. On request, VEDA will provide a copy of your credit history to yourself or any third party you authorise.

By UNO home loans, October 13th, 2022

- Articles

- FAQs

You can write a note along side a document to let us know if a document should be removed and we’ll do that for you.

By UNO home loans, October 13th, 2022

- FAQs

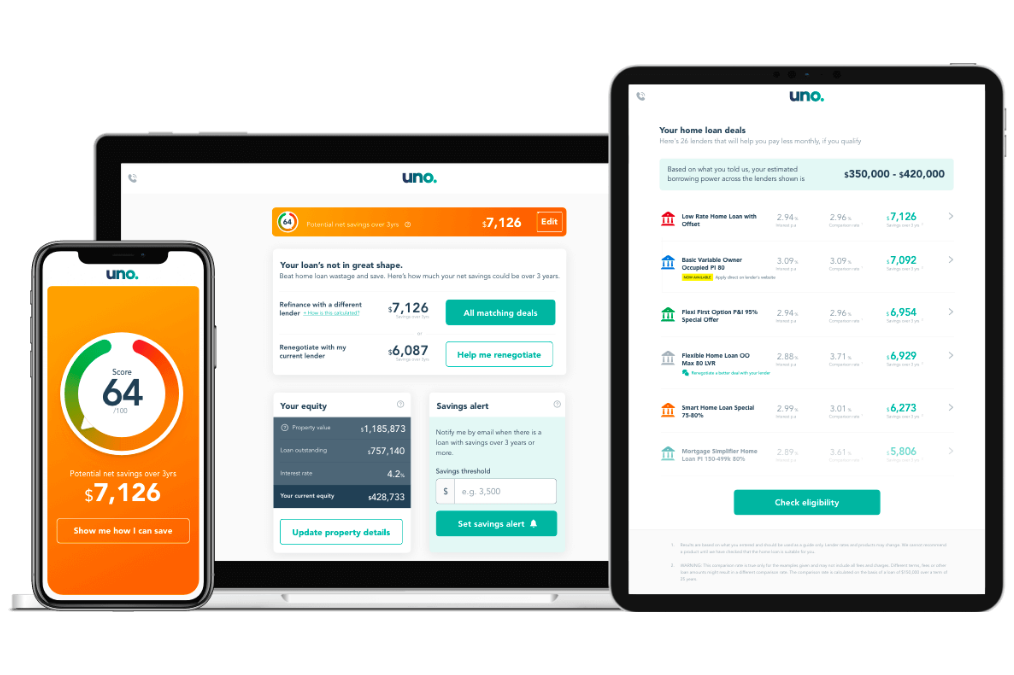

uno is an Active Home Loan Manager, meaning we not only help find a great home loan deal from 20 Australian lenders (including all the majors and smaller lenders) but help keep you on a great deal. Here’s how we get active on your home loan.

By UNO home loans, October 13th, 2022

- FAQs

UNO is Australia's Online Mortgage Broker. This credit guide outlines our obligations and key information related to our credit assistance (mortgage broking) services

By UNO home loans, October 13th, 2022

- Articles

- FAQs

Yes, we will do our best to help you organise finance to ease the stress in that anxious period between buying and selling a home.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Use UNO’s Stamp Duty Calculator for a guide on stamp duty costs.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

You can book in a time using our online booking link or email us

By UNO home loans, October 12th, 2022

- Articles

- FAQs

We can help if you need an urgent approval. Contact us immediately on 133 866 or through online chat.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Simply let us know by calling our support line on 133 866, or through online chat.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, but only in accordance with our privacy policy, which you can read here.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

We may contact you through push notifications, email or phone at important milestones, such as when your loan is approved.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, you can speak with our support team from 8am to 10pm (AEST) Monday to Friday, and 8am to 8pm on the weekend. Simply call our support line on 133 866 or request a call back.

By UNO home loans, October 12th, 2022

- FAQs

We understand how important it is to protect your personal information. This policy explains how your personal information will be treated, including when you access and interact with this website.

By UNO home loans, October 12th, 2022

- FAQs

These terms and conditions apply to this website and any other websites, including any microsites and mobile websites, as well as any mobile applications (collective referred to as the Services in this document) operated by or on behalf of Planwise AU Pty Ltd

By UNO home loans, October 12th, 2022

- Articles

- FAQs

loanScore is a simple way of seeing if the home loan you have at the moment is a good deal or not. We want you to know whether you are getting a good deal based on your circumstances such as the value of your property, the preferences you have for your loan

By Meredith Williams, October 12th, 2022

- Articles

- FAQs

What we can do is offer a free valuation for your target property. Just contact us on 133 866 or via online chat.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is available on all digital devices. You can find us on the web through your laptop, desktop computer, tablet or mobile phone.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No, your credit rating is based on your credit history. Using UNO won’t affect your credit history. Lenders refer to credit ratings when they consider loan applications.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO currently uses the industry-standard TLS certificate with 1024-bit encryption for your data security.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

The search order is determined only by the total cost of the home loan. While lenders pay commissions to get a higher listing on comparison sites, UNO is different – it arranges its home loans according to how suitable they are for your needs.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, we’re here to help you get a suitable home loan deal for your unique circumstances. That’s why it’s important that you discuss your needs with our experts to help ensure the product that’s recommended is right for you.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO gives you a completely transparent view of the home loans available to you from our panel of lenders. That’s why the home loan recommendations you discover through UNO are based entirely on your specific financial needs and circumstances.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO has an Australian Credit Licence through ASIC and all of our loan writers are accredited under that licence. We are also members of the Mortgage and Finance Association of Australia.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is ideal for all private borrowers: first home buyers, refinancers, debt consolidators or anyone looking to upgrade or renovate their home.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No. The home loan options UNO recommends to you are chosen based on their suitability for your situation and needs.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is an online service that helps you broker a better home loan and get expert help when you need it.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, but how much you save on your mortgage payments through refinancing depends on a number of factors.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

UNO is an online service that helps you broker a better home loan and get expert help when you need it. You can research and apply for your new home loan on one easy-to-use online platform.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Your lender chooses one of three methods to value properties – electronic valuation, drive-by valuation and in-house valuation.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Well, you won’t know that for certain until someone makes you an offer!

By UNO home loans, October 12th, 2022

- Articles

- FAQs

A pre-approval or conditional approval from a lender typically lasts 90 days.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

No one wants to borrow more than is necessary, of course, but it can be difficult to predict exactly how much you will need.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

It’s best to contact your home loan lender immediately if you suffer a loss of income for any reason.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

The decision to fix your interest rate will depend on your goals, financial situation and risk appetite. It is best to understand how fixed and variable interest rate options work and the pros and cons for both.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Lenders Mortgage Insurance (LMI) is paid on all home loans by the lender to a third party or in-house insurance organisation.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

A comparison rate gives you an indication of the true cost of a loan. It’s a way of comparing loans equally by including known fees (upfront, ongoing and exit) on top of the interest rate and is calculated on a $150,000 loan over 25 years.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

There are many other costs you need to think about when organising a home loan: application fees; valuation fees; settlement fees; ongoing account keeping fees; variation fees; repayment holiday fees; security substitution fees; discharge fees...

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Lenders in Australia calculate and accrue interest charges every day.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

This includes interest-only loans, low-doc loans, fixed rate and variable rates, loans for first home buyers, as well as loans for investment properties.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

You can approach a bank directly if you wish but UNO gives you access to a large number of major and specialist home loan lender in Australia.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, UNO is accredited with a number of lenders, which means we can offer advice on a range of home loan and credit products.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, UNO is accredited with a number of lenders, which means we can offer advice on a range of home loan and credit products.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Use the Profile screen which you can access here to edit any of the data for your home loan product search.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Yes, just speak to your home loan expert about starting a second application.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

You may need to verify your identification, and this is likely to depend on whether you’re already banking with your preferred home loan lender.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Your uno Dashboard contains a to-do list and a document checklist. These have been tailored by our home loan experts to show what needs to be done at every step.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Signing documents for your loan contact will vary depending on the lender. You may sign documents with your solicitor or at the lender’s branch.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Just log into your uno account and check the uno Dashboard to see your application status. Otherwise, you can always contact us on 133 866 or through online chat.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

An offset account can make a massive difference to the total cost of a home loan, but only if you know how to use it effectively.

By UNO home loans, October 12th, 2022

- Articles

- FAQs

Ever wondered: What size deposit will I need? What can I do if I have less than required? How does it benefit me if I have more than what’s required?

By UNO home loans, October 11th, 2022

- Articles

- FAQs

UNO is Australia’s first Active Home Loan Manager helping Australians start on a great home loan and stay on a great home loan as long as they have one.

By UNO home loans, October 11th, 2022

- Articles

- FAQs

Yes, uno helps you choose from the best loans for owner-occupied homes and investment properties.

By UNO home loans, October 11th, 2022

- Articles

- FAQs

Your home loan borrowing power is the maximum amount that lenders will let you borrow based on your unique financial situation.

By UNO home loans, July 1st, 2022

- Articles

- FAQs

Finding the right home loan for you is simple with UNO. Here are the steps in our application process.

By UNO home loans, May 20th, 2022