Jordan White

6th July 2023

First home buyer Victoria: your guide to FHOG / first home buyers grant, stamp duty concessions/exemptions, and more.

First home buyers in Victoria face a tough market, with a median house price of $760,000 - among the highest in the nation. In Melbourne, which consistently ranks among the most livable cities in the world, the median increases to nearly $1 million.

With these prices, it takes almost 14 years for first home buyers to save a 20% deposit, according to ANZ and CoreLogic research.

State and federal governments offer several concessions to help first home buyers with rising property costs. Here’s everything you need to know about first home buyer concessions in Victoria.

Victoria's first home buyer grants and concessions include the following:

In VIC, a $10,000 FHOG is available when you buy or build a new home for the first time. The property’s contract price cannot exceed $750,000. Eligible recipients must meet the below criteria:

The Victoria First Home Owner Grant is a scheme co-funded by the Victorian and Federal governments designed to promote homeownership for first-home buyers.

Australian Defence Force (ADF) members—including members of the Australian Army, Air Force, or Navy—are exempt from the occupancy requirements provided they are enrolled to vote in Victoria.

A UNO broker will help determine your eligibility for the FHOG grant.

Victorian home buyers are eligible for stamp duty (duty) concessions or exemptions provided they bought their home after 1 July 2017.

Properties valued at less than $600,000 are eligible for a first home buyer exemption, while those valued at $600-750,000 qualify for a first home buyer duty concession.

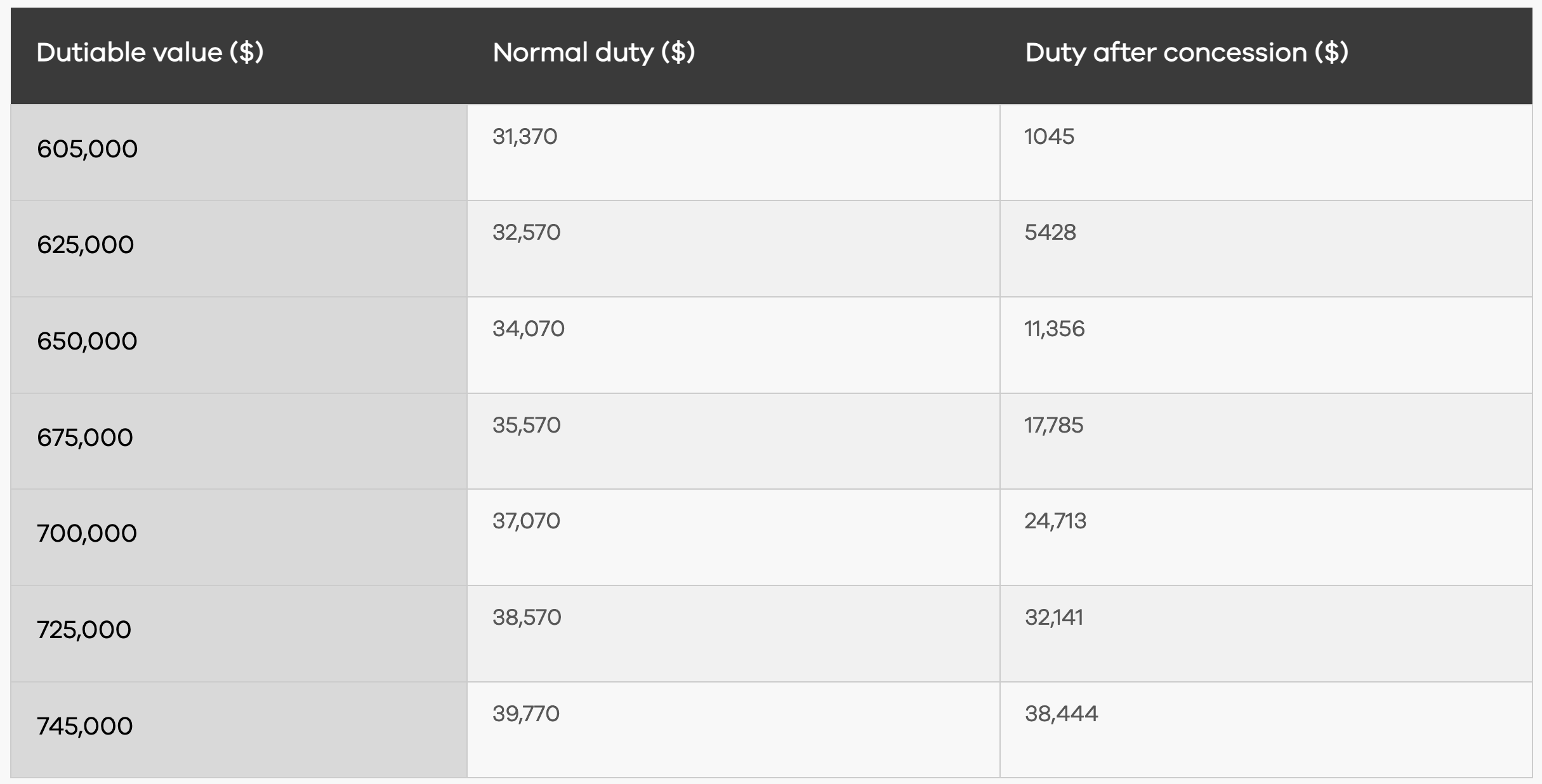

The first home buyer duty concession is a rate based on the value of your property. The more expensive your property, the less discount you will receive.

Victorian First Home Buyer Duty Concession discounts

To be eligible for an exemption/concession, purchases must meet the same criteria as the FHOG grant. However, the property does not need to be new.

Additionally, there is a duty discount for properties within the City of Melbourne local government area (LGA) valued at up to $1 million. Contracts need to have been entered between 2021-2022.

Estimate your stamp duty with UNO’s stamp duty calculatorThe Victorian Homebuyers Fund (VHF) is a shared equity scheme where the Victorian Government contributes to the cost of a property in exchange for a stake in it.

Eligible individuals must have a single or combined income below $208k and $130k, respectively. Assess your eligibility here.

Under the scheme, the government will buy a share of up to 25% in your property provided you have a genuine savings deposit of at least 5%.

No interest is payable on the government’s share, but they will take a percentage of the profits when you sell it. You can pay back the government’s share in the property over time.

The regional FHOG was a $20,000 grant for first home buyers who purchased a property in regional Victori between July 2017 and 2021. It ended in 2021.