UNO home loans

18th May 2022

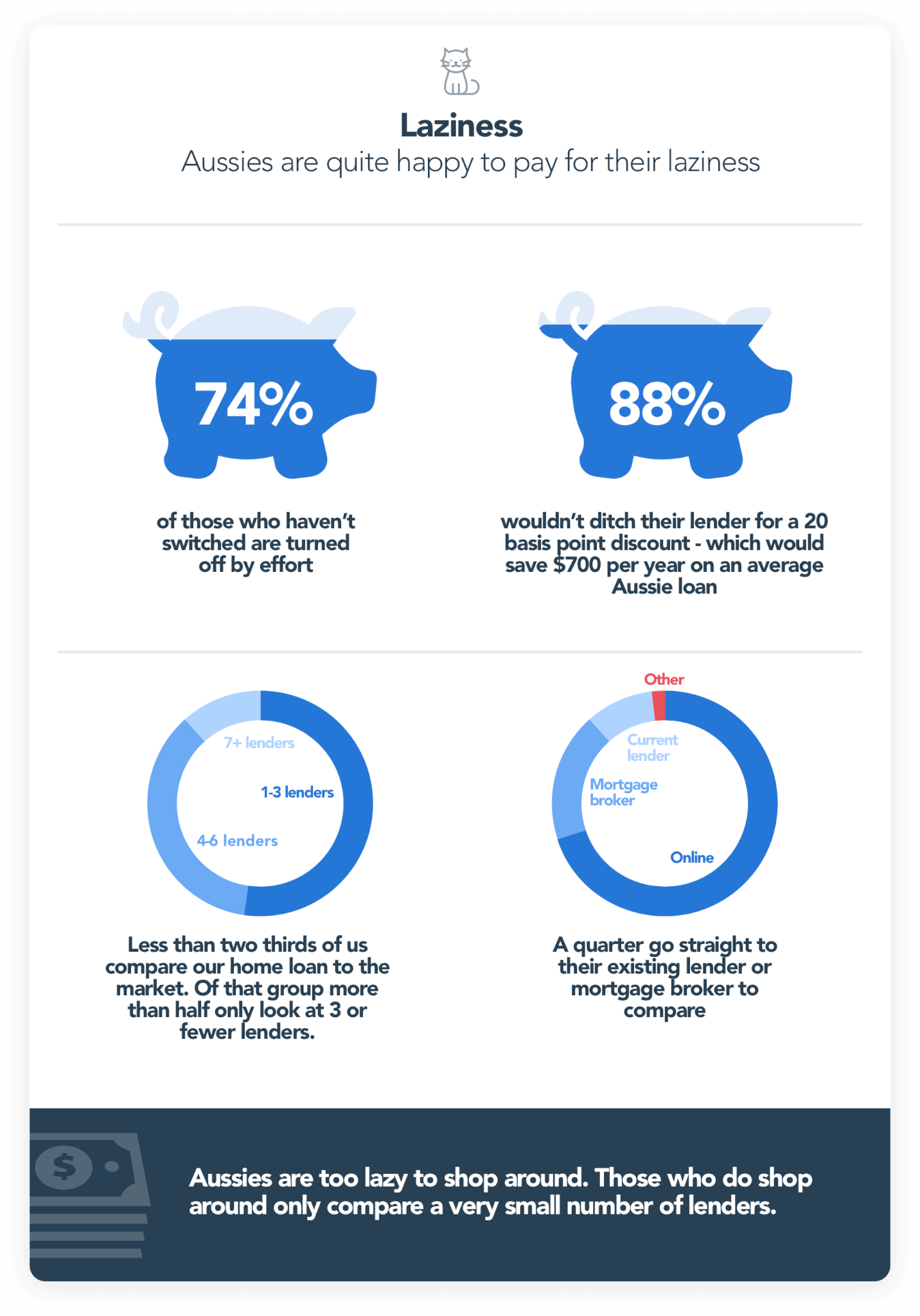

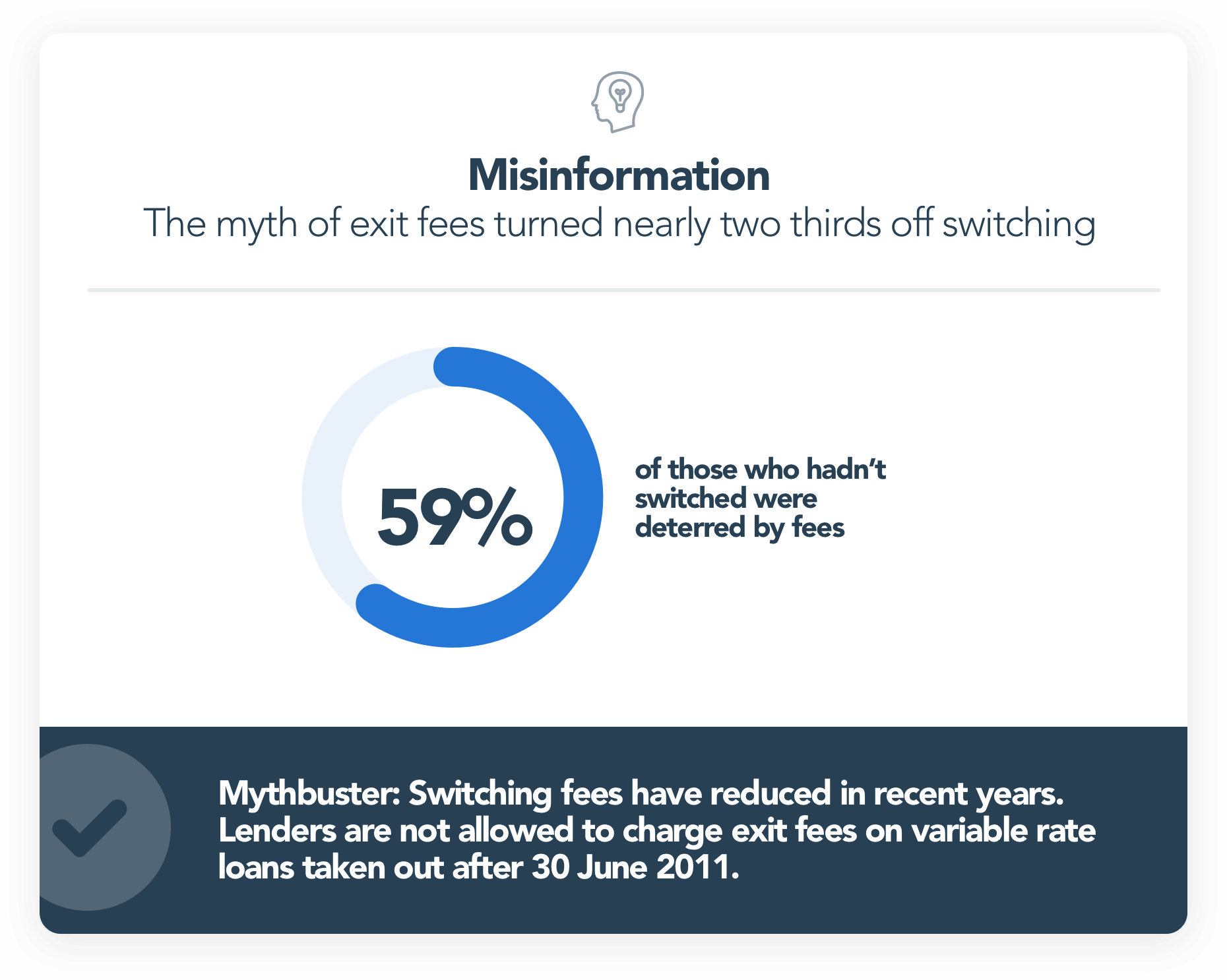

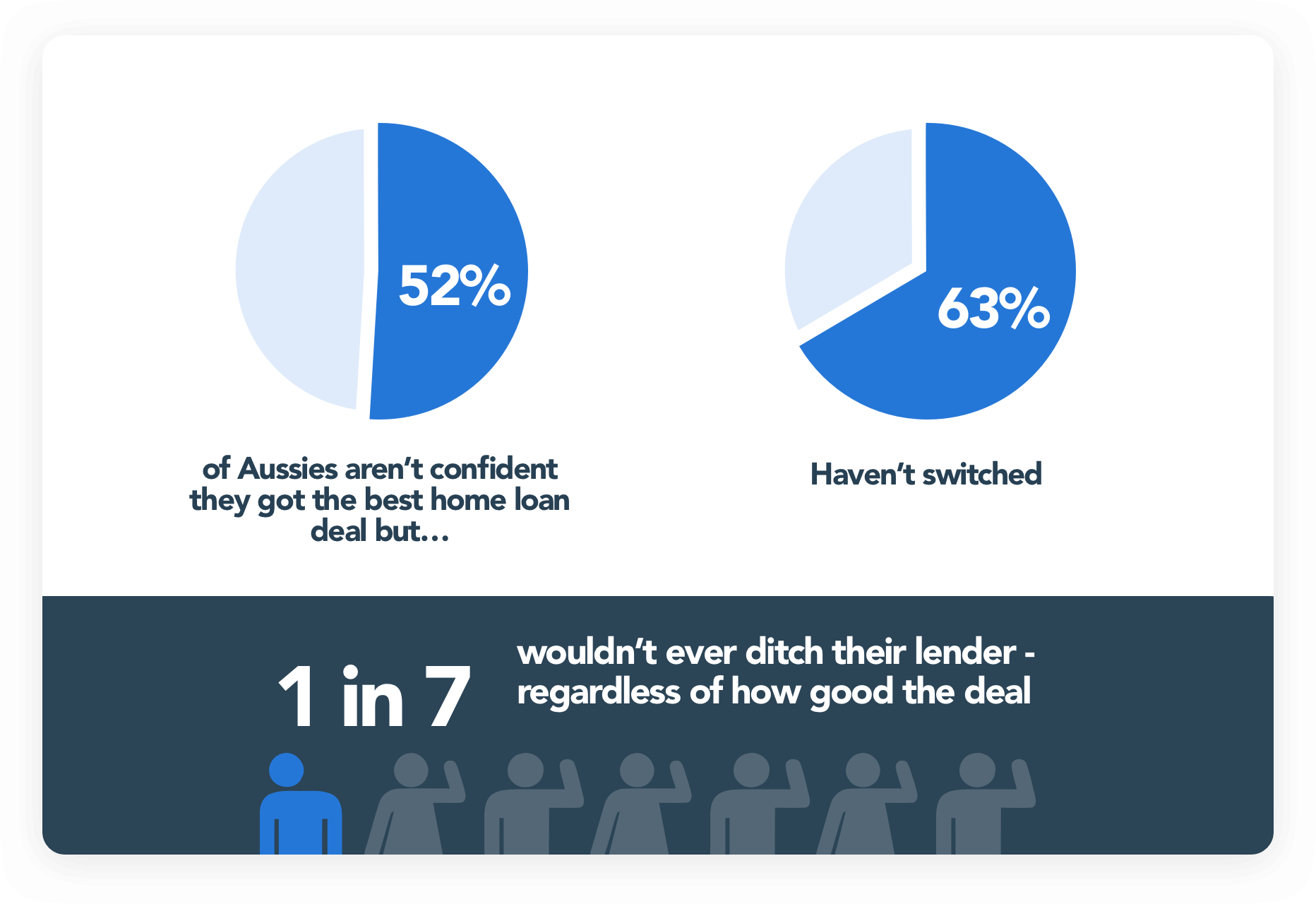

Australians’ laziness, loyalty and fear is costing the average home borrower who doesn’t switch more than $14,000. Our data shows potentially more than 60% of Australians fall into this category. We were shocked that one in seven Australians wouldn’t change their lender no matter how big the savings on the table.

Australians’ laziness, loyalty and fear is costing the average home borrower who doesn’t switch more than $14,000. Our data shows potentially more than 60% of Australians fall into this category.

We were shocked that one in seven Australians wouldn’t change their lender no matter how big the savings on the table.

So why are Aussies so apathetic when they know it’s costing big bucks?

We dug deep and uncovered…

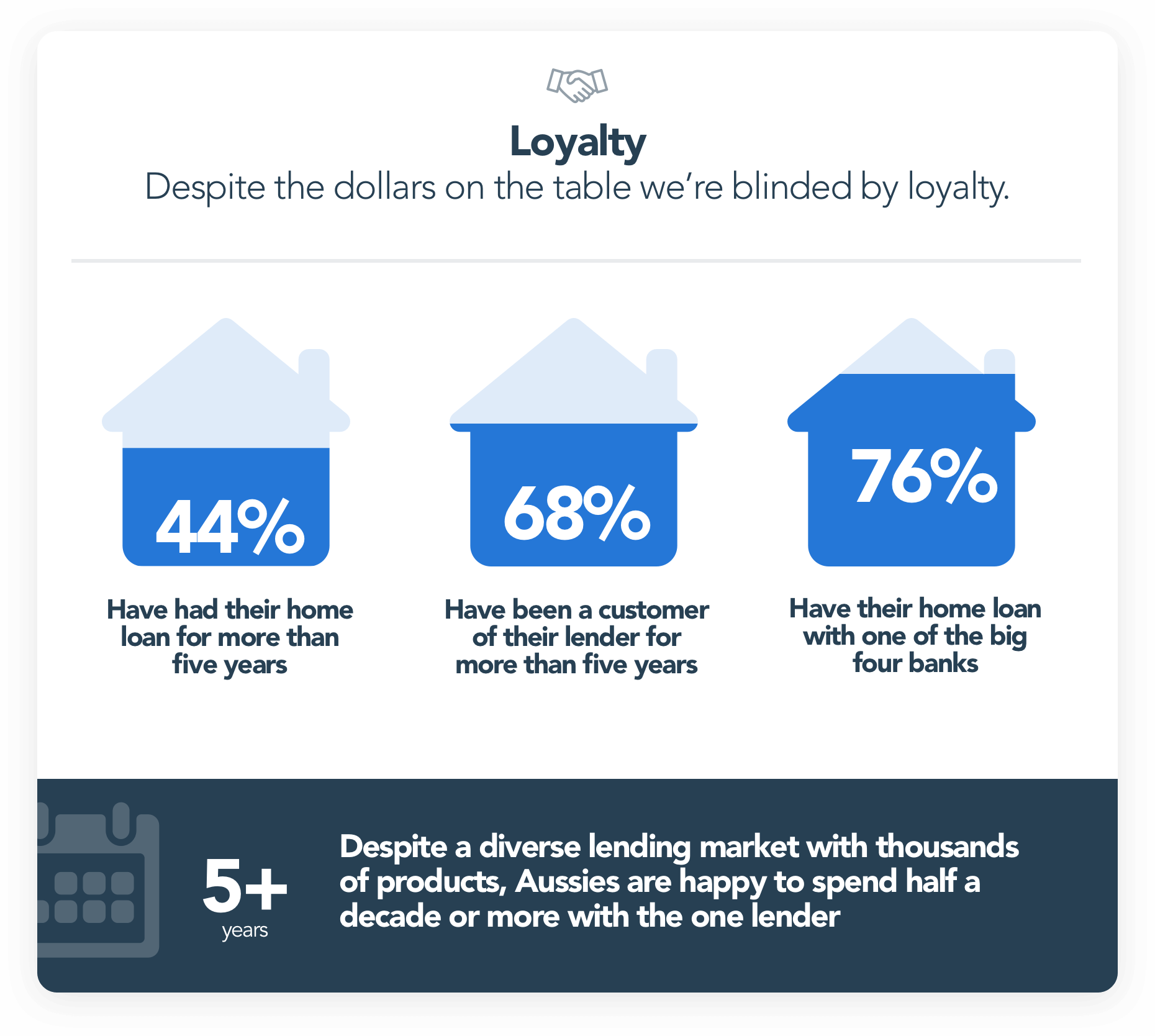

Non-switchers are penalised for their apathy – with higher rates of 13 basis points more on average.

Many Australians are fiercely loyal, spending a long period on the same deal and opting for well-known lenders.